PACCAR Credit App 2004-2026 free printable template

Show details

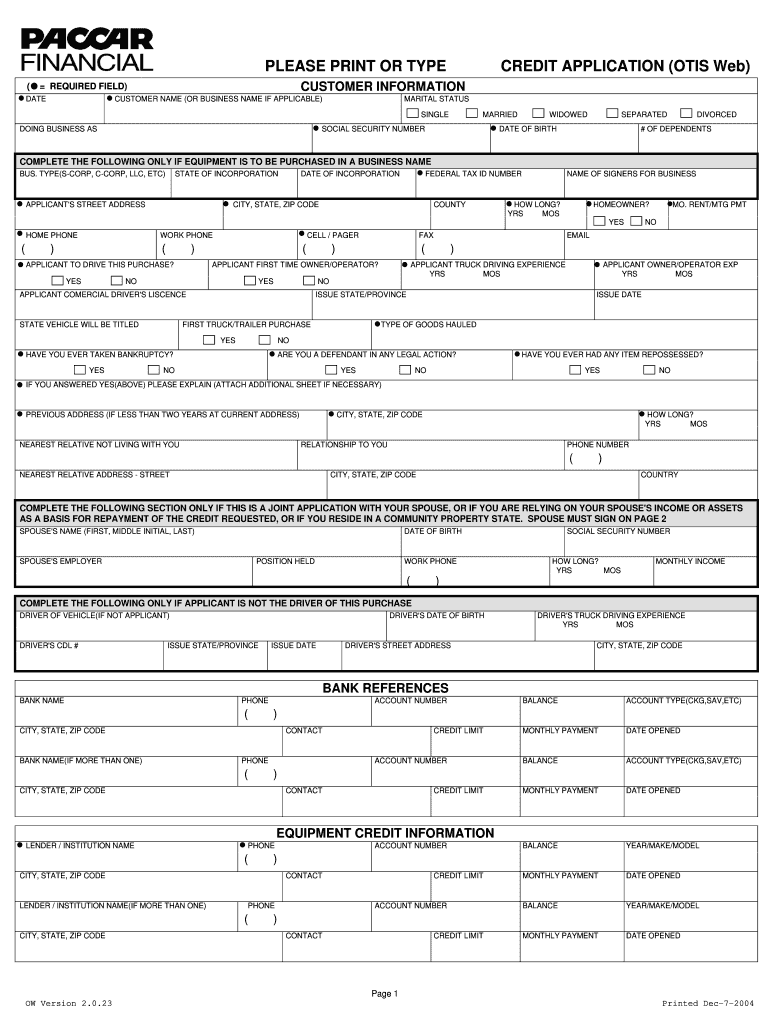

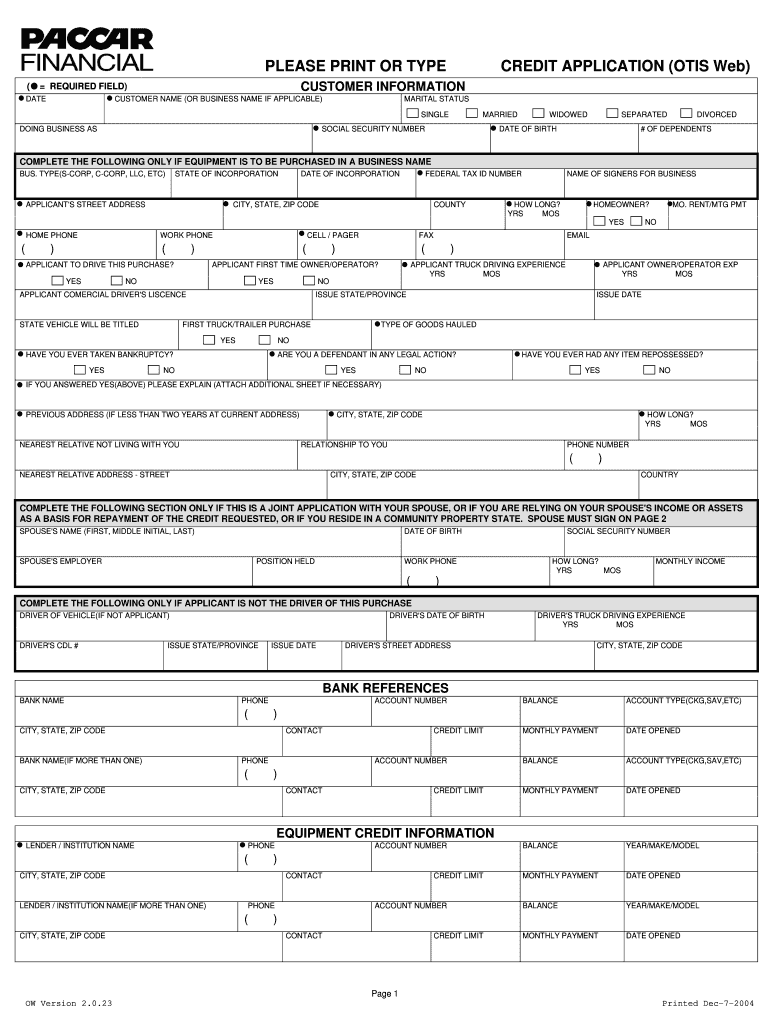

I understand that PACCAR Financial Corp. and/or Seller of motor vehicle parts or services to whom this application is presented will be relying on the accuracy of the matters set forth herein as a basis for extending any credit which I may receive. PLEASE PRINT OR TYPE CUSTOMER INFORMATION REQUIRED FIELD DATE CREDIT APPLICATION OTIS Web CUSTOMER NAME OR BUSINESS NAME IF APPLICABLE MARITAL STATUS SINGLE DOING BUSINESS AS MARRIED SOCIAL SECURITY NUMBER WIDOWED SEPARATED DATE OF BIRTH DIVORCED...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign paccar truck financing form

Edit your paccar financial credit requirements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your paccar financial credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing paccar credit app is a equipment managed by paccar financial online

Follow the steps down below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit paccar financial canada form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application paccar credit form

How to fill out PACCAR Credit App

01

Obtain the PACCAR Credit Application form from the PACCAR website or your dealership.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide your business information if the application is for a business, including the business name, address, and type of business.

04

Enter your financial information, including income, debt, and assets as required.

05

Include references, typically necessary business or personal references.

06

Review all information for accuracy before submitting.

07

Sign and date the application where indicated.

08

Submit the application electronically or by mail as per the instructions provided.

Who needs PACCAR Credit App?

01

Individuals or businesses looking to finance the purchase of PACCAR products such as trucks and trailers.

02

Dealerships and small fleet operators who require credit to manage their vehicle inventory.

03

Companies expanding their operations who need access to PACCAR financing options.

Fill

paccar financial corp

: Try Risk Free

People Also Ask about paccar financial

How do you fill out a credit card application?

0:25 1:51 How to Fill Out a Credit Card Application - YouTube YouTube Start of suggested clip End of suggested clip Then click on the application link from the issuer's credit card. Page second fill in some basicMoreThen click on the application link from the issuer's credit card. Page second fill in some basic personal information like your name address date of birth. And social security.

What is the credit application process?

A credit application can be submitted in writing either through online and offline modes or orally in person at the lender's premises. A credit application should have all requested details, without which the lender will not be able to proceed with a credit application.

What is a signed credit application?

A credit application is a standard agreement you sign with another business to receive goods or services on credit. This agreement will include: payment terms; and. any other additional terms of the agreement, such as the penalties you will face if a default occurs.

How to fill up credit application form?

0:31 1:56 Learn How to Fill the Credit Application form - YouTube YouTube Start of suggested clip End of suggested clip Information in the next section. Provide your shipping and billing contact. Information.MoreInformation in the next section. Provide your shipping and billing contact. Information.

Who fills out a credit application?

A credit application is filled out by a borrower and submitted to a lender to request a loan or other financing. A contractual relationship begins between the borrower and that lender when the lender receives a credit application.

What is required for a credit application?

The amount of credit requested. The identification of the applicant. The financial status of the applicant. The names of credit references.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send paso credit for eSignature?

To distribute your PACCAR Credit App, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get PACCAR Credit App?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific PACCAR Credit App and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out PACCAR Credit App using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign PACCAR Credit App and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is PACCAR Credit App?

PACCAR Credit App is a financing application for customers seeking credit to purchase PACCAR products, such as trucks and equipment, managed by PACCAR Financial.

Who is required to file PACCAR Credit App?

Any individual or business seeking financing through PACCAR Financial for the purchase of PACCAR vehicles or equipment is required to file the PACCAR Credit App.

How to fill out PACCAR Credit App?

To fill out the PACCAR Credit App, applicants need to provide personal and business information, financial statements, and other relevant documentation. The application can typically be completed online or by submitting physical forms.

What is the purpose of PACCAR Credit App?

The purpose of the PACCAR Credit App is to evaluate the creditworthiness of applicants seeking financing for PACCAR products, ensuring that they can meet their repayment obligations.

What information must be reported on PACCAR Credit App?

Information that must be reported on the PACCAR Credit App includes personal identification details, business entity information, financial statements, credit history, and other relevant financial data.

Fill out your PACCAR Credit App online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PACCAR Credit App is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.